Merit is frequently asked to help businesses, federal agencies and membership organizations reduce or mitigate risk – regardless of their size and business type. Often their project teams collaborate and discuss methods for improving their risk status but have proven to be flawed. The most common flaw that sets them back is their goal to have all risk plans drive their risk probability and impact to zero, in which case it would not be a risk.

Standard risk responses include Avoidance, Mitigation, Transference, and Acceptance (passive/active). At Merit, we developed a reporting process that would show that the risk factors were decreasing as the project progressed. Supplemented with suitable risk responses, the true reduction of risk probability occurs over time.

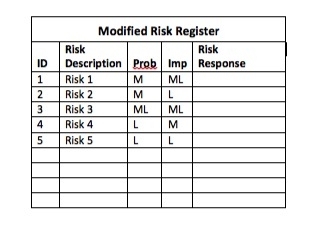

Standard risk responses include Avoidance, Mitigation, Transference, and Acceptance (passive/active). At Merit, we developed a reporting process that would show that the risk factors were decreasing as the project progressed. Supplemented with suitable risk responses, the true reduction of risk probability occurs over time.The added value that we incorporated into the risk management process was two-fold. First, because of the desire to drive the risk to as low as possible, the use of multiple risk responses could be utilized. The second process improvement would be not only to subsequently reassess the risk, but also to re-evaluate the risk probability and impact matrix after the implementation of the risk response over time.

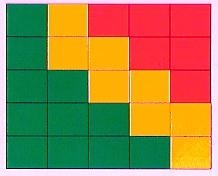

The Probability and Impact Matrix is one of the tools that we recommend in a risk management strategy. It is superimposed with risks that are labeled or numbered as in the above example. “Red” area risks were uniquely documented on a trending month-to-month basis such that it could be seen “driving” toward zero.

The Probability and Impact Matrix is one of the tools that we recommend in a risk management strategy. It is superimposed with risks that are labeled or numbered as in the above example. “Red” area risks were uniquely documented on a trending month-to-month basis such that it could be seen “driving” toward zero.The implementation of a risk response would then “reclassify” the risk event for the next reporting period. However, the biggest impact on reducing risk is time. Time because we are progressively refining our process as our project develops, and because the physical window (amount of time available) for a risk event is reduced.

We invite you to learn about our modified process template so you too can incorporate it into your project plans. For more information, to learn other advanced risk monitoring, reporting, and controlling techniques or to schedule a risk management training customized for your team, contact Jim Wynne at jwynne@meritcd.com or by calling (610) 225-0449.

Comments

No comments